期货为什么要提前结算(期货为什么要提前结算呢)

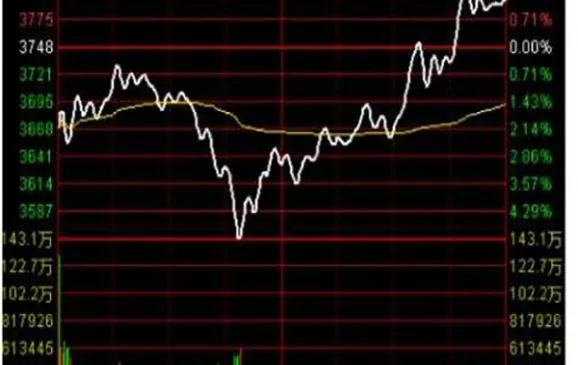

期货市场是金融市场中最重要的衍生品市场之一。期货合约是一种标准化合约,规定了在未来某个特定日期按照约定的价格和数量交割一定标的资产。与股票市场不同,期货合约并不是无限期的,而是设置了交割日。在交割日之前,交易所要求期货合约进行结算。为什么期货要提前结算呢?本文将从市场流动性、风险管理和交易效率三个方面解析这个问题。

1. 市场流动性

期货市场的流动性对市场参与者而言非常重要。流动性指的是市场上能够快速买入或卖出大量合约而不对市场价格产生较大影响的能力。如果期货合约不进行提前结算,投资者就必须等到交割日才能结束合约。这会导致市场流动性下降,因为投资者需要长时间才能转换其投资组合。提前结算可以帮助市场维持流动性,提高市场的交易活跃度。

2. 风险管理

提前结算还有助于风险管理。期货市场涉及大量的杠杆交易,投资者只需支付一部分保证金就可以控制更大价值的资产。杠杆交易也意味着潜在的巨大风险。如果期货合约不进行提前结算,投资者可能会面临无法及时平仓的风险。提前结算使得投资者能够在交割日之前及时平仓,规避潜在的风险。

3. 交易效率

提前结算还有助于提高交易效率。期货市场是一个高度活跃的市场,每天都有大量的交易活动。如果期货合约不进行提前结算,交易所可能无法及时结算所有的交易。这会导致交易所运营效率低下,可能会对市场的信誉产生负面影响。提前结算可以确保交易所能够按时完成结算,提高交易效率。

期货为什么要提前结算呢?提前结算有助于维持市场的流动性,提高交易活跃度。提前结算可以帮助投资者规避风险,及时平仓。提前结算还有助于提高交易所的运营效率,维护市场的正常运转。提前结算对于期货市场的健康发展非常重要。

参考译文:

Why is Early Settlement Important in Futures Trading?

Futures market is one of the most important derivative markets in the financial industry. Futures contracts are standardized agreements that specify the delivery of a certain underlying asset at a predetermined price and quantity on a specified future date. Unlike the stock market, futures contracts have a specific delivery date and require settlement before the delivery date. But why is early settlement necessary in futures trading? This article will analyze this question from the perspectives of market liquidity, risk management, and trading efficiency.

1. Market Liquidity

Market liquidity plays a crucial role for participants in the futures market. Liquidity refers to the ability of the market to quickly buy or sell a large number of contracts without significantly impacting market prices. If futures contracts are not settled early, investors would have to wait until the delivery date to close their contracts. This would lead to a decrease in market liquidity, as investors need a longer time to convert their investment portfolios. Early settlement helps maintain market liquidity and enhances trading activity.

2. Risk Management

Early settlement also facilitates risk management. The futures market involves a significant amount of leveraged trading, where investors only need to deposit a fraction of the contract value as margin. However, leveraged trading also implies potential significant risks. If futures contracts are not settled early, investors may face the risk of being unable to close their positions in a timely manner. Early settlement allows investors to close their positions before the delivery date, mitigating potential risks.

3. Trading Efficiency

Early settlement also improves trading efficiency. The futures market is highly active, with a large volume of trading activities occurring every day. If futures contracts are not settled early, the exchange may not be able to settle all the trades in a timely manner. This would result in inefficient operations of the exchange and may have a negative impact on the market\'s reputation. Early settlement ensures that the exchange can complete settlements on time, enhancing trading efficiency.

In conclusion, why is early settlement important in futures trading? Firstly, early settlement helps maintain market liquidity and enhances trading activity. Secondly, early settlement allows investors to manage risks by closing their positions in a timely manner. Lastly, early settlement improves the operational efficiency of the exchange and ensures the smooth functioning of the market. Therefore, early settlement is crucial for the healthy development of the futures market.