苯乙烯期货规定(苯乙烯期货最新策略)

苯乙烯是一种重要的化工原料,广泛用于制造塑料、合成橡胶和其他产品。其价格波动对相关产业链有着深远影响。了解苯乙烯期货规定至关重要,这将帮助交易者制定有效的交易策略,把握市场先机,实现获利目标。

什么是苯乙烯期货?

苯乙烯期货是一种标准化期货合约,代表在未来特定日期以特定价格买卖一定数量苯乙烯的协议。期货合约允许交易者在未来预先锁定价格,从而规避价格风险。

苯乙烯期货规定

合约规格:

- 合约单位:10吨

- 最小变动价位:1元/吨

- 交易时间:上午9:00-下午3:00

保证金比例:

- 开仓保证金比例:10%

- 平仓保证金比例:5%

交割方式:

- 实物交割:交易者可以提取或交付实物苯乙烯

- 现金交割:交易者以现金结算合约差价

交割日期:

- 每月最后一个交易日

交易规则:

- 双向交易:交易者可以买入或卖出期货合约

- 涨跌停板:每日涨跌停板幅度为前一交易日结算价的±5%

- 限仓:每个交易者持有的同一合约买方或卖方头寸不得超过交易所规定的限仓量

苯乙烯期货交易策略

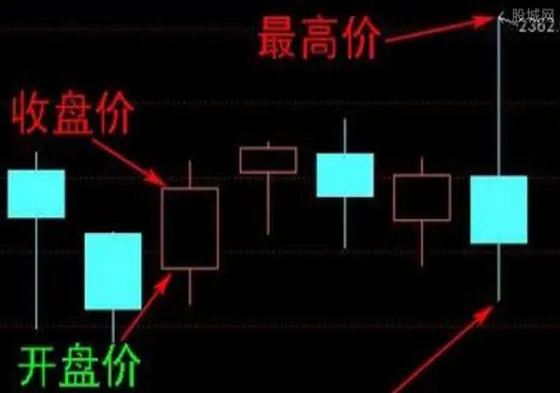

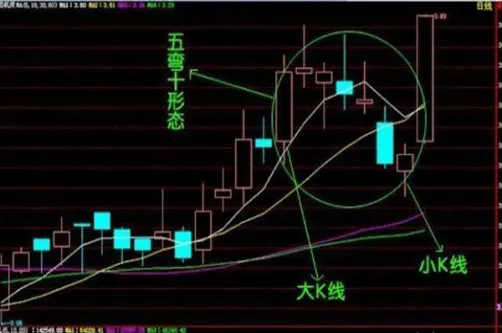

趋势交易:

- 识别苯乙烯价格的趋势,并顺势交易

- 使用技术指标,如移动平均线和布林带,确认趋势

- 在价格突破趋势线时进场交易,止损设在趋势线附近

区间交易:

- 确定苯乙烯价格的支撑和阻力位

- 在价格触及支撑位时买入,在触及阻力位时卖出

- 设置止损和止盈单,以限制风险和锁定利润

套利交易:

- 同时进行买入远月合约和卖出近月合约

- 利用远月合约和近月合约之间的价差获利

- 套利交易需要较高的交易技巧和资金管理能力

风险管理

- 止损单:在每次交易中设置止损单,以限制潜在损失

- 仓位管理:控制交易仓位的大小,避免过度交易

- 资金管理:分配适当的资金用于交易,避免过度风险

- 技术分析:使用技术分析工具,如趋势线和技术指标,判断市场走势和风险点

understanding the regulations of styrene futures is crucial for traders to develop effective trading strategies and capitalize on market opportunities. By adhering to the contract specifications, margin requirements, and trading rules, traders can mitigate risks and increase their chances of success in the futures market. With careful planning, risk management, and a deep understanding of the market dynamics, traders can navigate the complexities of styrene futures trading and achieve their financial goals.

THE END